OUR SERVICES.

We have a range of services and options for every aspect of supporting you with corresponding with HMRC. Our services are built around provision of consistent, friendly and personal service and our packages are designed to support an ongoing, frequent use model, not the usual models of charging you for every interaction in case we never hear from you again!

Explore the options below, perhaps run through the brief pre-application form on the right hand side to see whether our services are right for you or of course, just give us a call and we can talk about your situation to see how we can help.

As A Contractor

HMRC Will Want To Check Your Income Tax Position.

It Is Highly Likely You Will Be Contacted By HMRC.

Annual Support Service.

MOST POPULAR PACKAGE

Our most popular service is our Annual Support package. Why? Because a one off payment covers all your HMRC letters for the year, alongside assistance with HMRC investigations, and a simple assessment. In short, you get unlimited access to our team who will act on your behalf so no matter what comes through your letterbox from HMRC, you can just pass it on to us.

Starting from:

£519

Self-Assessment.

If you are unsure about completing your Self-Assessment, we can take away that stress and process this on your behalf. You can add this onto your Annual Support Service or just get a one off standard Self-Assessment with us.

Get in touch, let’s talk about what you need and you can decide whether you’d like us to take care of it for you.

Per tax year starting from:

£319

Emergency Support Service.

We appreciate that sometimes responding to HMRC may have slipped your mind or perhaps you just weren’t sure what to do. If you’re close to an HMRC deadline, our Emergency Support Service is perfect for contractors who need a response within 30 days. This service means we can assist with 1 letter and respond on your behalf. But because HMRC usually requires multiple responses, we highly recommend the Annual Support Service for the best value.

Starting from:

£419

Corporation Tax Return.

Every UK based limited company is required to pay corporation tax on their profits, spendings and company tax figures to HMRC. In order to meet legal obligations, and avoid late filing penalties, a Corporation Tax Return must be filed before the deadline.

Starting from:

£499

Tax Return Bundle.

Get a £119 discount on your Self Assessment and Corporation Tax Return when you purchase our Tax Return Bundle.

Save £119:

£699

LETS HELP CHOOSE THE SERVICE FOR YOU

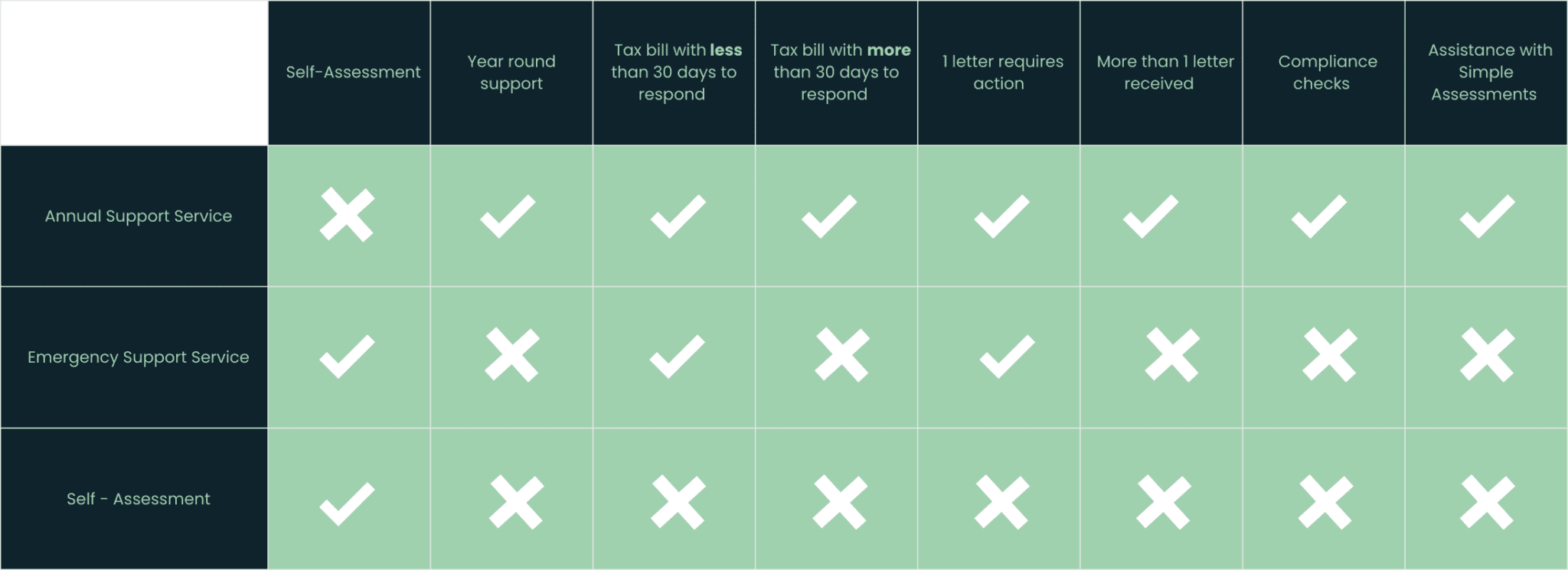

What Does The Package Include.

Whichever option you choose, you’ll receive the same attentive and friendly attention.

Here’s a quick guide to the different services included with each option.

BRINGING YOU THE BEST VALUE SOLUTION

How Do We Compare.

For contractors that need to jump the queue our Emergency Support Service gives your issue priority attention, but we recommend investing in our Annual Support Service simultaneously as it is highly likely that HMRC will contact you multiple times. The annual package also supports you through likely future communications.

LET US HELP YOU DECIDE

Contact Us For Help.

Still need more help deciding what support service is best for you? Contact our team! Unlike so many others, we don’t charge for a phone call and are always on hand to support contractors.

Assist@ContractorsSupport.co.uk

0151 440 2087